IMPORTANCE OF YOUR CAR LOAN VALUE

LOAN VALUE OF CARS

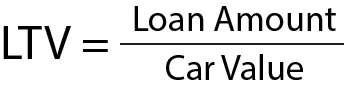

The loan value of your car, often referred to as the Loan-to-Value (LTV) ratio when discussing vehicle financing, is quite important for several reasons:

- Financing Approval: The LTV ratio is a key factor that lenders consider when deciding whether to approve your car loan. It represents the amount of the loan in relation to the value of the car. A lower LTV ratio (meaning the loan amount is a smaller percentage of the car’s value) is generally more favorable and may increase the likelihood of loan approval.

- Interest Rates: The LTV ratio can also affect the interest rate on your loan. Higher LTV ratios are generally seen as higher risk, which can result in higher interest rates. Conversely, a lower LTV ratio might qualify you for lower interest rates, reducing the overall cost of the loan.

- Equity Position: If the LTV ratio is high, you might owe more on the car than it’s worth, especially if the car’s value depreciates rapidly. This situation, known as being “upside down” or having “negative equity,” can be problematic if you want to sell or trade in the car before the loan is paid off.

- Impact on Monthly Payments: A higher LTV ratio typically means higher monthly payments, as you’re financing a larger portion of the car’s value. This can have significant implications for your budget and financial planning.

- Insurance Implications: Cars with high LTV ratios might require additional insurance coverage, such as gap insurance. Gap insurance covers the difference between what you owe on the car and its value if it’s totaled or stolen, which is crucial if you have a high LTV ratio.

- Resale and Trade-In Value: A lower LTV ratio gives you more flexibility when it comes to selling or trading in your vehicle. If the loan value is less than the car’s worth, you have positive equity, which can be used as a down payment for your next car or pocketed as cash when selling the vehicle.

- Risk Management: A lower LTV helps in managing financial risk. In case of financial hardship, it’s easier to sell or refinance the car when the loan value is not excessively higher than the car’s market value.

In summary, the loan value of your car is an important factor in the overall financial aspects of car ownership, affecting everything from your car loan approval to your financial flexibility and obligations during the term of the loan. It’s wise to aim for a low LTV ratio by making a substantial down payment (20% or more) or choosing a more affordable car.