CAR GAP INSURANCE EXPLAINED

GAP INSURANCE EXPLAINED

GAP insurance, which stands for Guaranteed Asset Protection, is a type of car insurance policy that covers the difference between the actual cash value (ACV) of a vehicle and the balance still owed on the financing (car loan or lease).

If you don’t put enough money down on your vehicle purchase, you may need this coverage in the event your car is totaled or stolen.

To avoid GAP Insurance expense, I advise people to put at least 20% cash down and pay for taxes, title and license fees, too.

GAP insurance is particularly important in situations where the depreciation of a car greatly outpaces the repayment of the loan (Like zero down deals and longer term loans).

Here’s a closer look at what GAP insurance does:

- Covers Depreciation: Cars depreciate rapidly, often losing 20-30% of their value in the first year and about 50-60% or more over three years. If your car is totaled or stolen, Your vehicle could be worth a lot less than the loan balance, and standard car insurance policies only pay out the car’s current market value. In this case, GAP insurance steps in to cover the “gap” between what you owe and the car’s depreciated value if your vehicle is a total loss.

- Loan/Lease Protection: If you have a car loan or are leasing a vehicle, GAP insurance can provide financial protection. Without GAP insurance, if your vehicle is a total loss, you could end up owing more than your car insurance company is willing to pay.

- Negative Equity Coverage: For those who put a small down payment or have a long-term loan (a very bad combination as i pointed out earlier), the risk of being “upside down” on the loan (owing more than the car’s value) is higher, especially in the early years of the loan. GAP insurance is particularly beneficial in these cases.

- Beneficial for Leased Cars: It’s often required for leased cars because, with leasing, you might have little to no equity in the vehicle throughout the duration of the lease.

- Peace of Mind: It offers peace of mind knowing that you won’t have a financial burden if your car is totaled or stolen and you owe more than its depreciated value. But, you DO NOT have to buy the overpriced policies available through dealer finance. You can get the same GAP policy through a Credit Union for half that cost, and it’s also available much cheaper through many different car insurance companies.

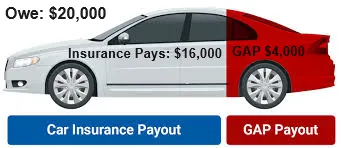

- How GAP Works: If your car is totaled, and you owe $20,000 on your loan, but the car’s current value is only $16,000, your standard car insurance will only pay out $16,000. GAP insurance would then cover the remaining $4,000. This gives you a paid off vehicle. See picture above

- GAP is Not a Replacement for Car Insurance: It’s important to note that GAP insurance is a supplement to, not a replacement for, standard car insurance. It doesn’t cover property damage, bodily injuries, or other liabilities.

- Policy Duration: Typically, GAP insurance is most relevant in the first few years of a new car purchase or lease, as this is when the gap between owed amount and car value is greatest.

- Cost and Purchase Options: GAP insurance can be purchased from car dealerships (but as I mentioned earlier, this is the most expensive option you have). You can also get GAP from some banks or credit unions, and some auto insurance companies. Prices vary, so it’s wise to shop around and compare rates.

In summary, GAP insurance might be a smart investment for those financing a new car with a small down payment, those who have a long-term loan, or those leasing a vehicle.

It provides financial protection against the big loss it’s possible for you to see, shortly after you buy your car.

I hope you enjoyed this brief but concise explanation of GAP Insurance.

To get access to tons of other FREE Car Buyer Resources, through the rest of our Car Buyers Blog, which is just loaded with information you need to know!

There are well over 20 Blogs for you to read, learn from, and find out how to become a smarter car shopper.

You can even print them off, put them in a 3-Ring Binder, and take them to the dealership with you, just like our viewer Joe LePore did!